Key concepts

Learn about important concepts for working with the Akahu Apply API

Applications

The core function of Akahu Apply is to provide insights over a dataset consisting of financial accounts and their transactions. An Akahu Apply Application represents a container where financial data can be imported, processed, and prepared for analysis.

For example, if you are using Akahu Apply as part of a lending workflow, a new Application should be set up in Akahu Apply for each lending application that you wish to process.

Resources

Financial data is added to an Application via one or more Resources. The data from multiple resources is compiled into a single aggregate dataset by generating a Report.

A Resource is a high level concept that can represent a number of concrete sources of financial data. Akahu Apply currently supports the following resource types:

Documents

One or more Documents can be uploaded to an Application as a way to import financial data for analysis.

A document represents a single PDF file containing financial statements that are relevant to the application.

When a document is uploaded to an Application, Akahu Apply will process the information from the document using text extraction and OCR methods, then convert it to a standardised format.

Documents can be added to an application using the Akahu Apply API, by your applicant directly using a Sharing Request, or using a combination of both. These upload methods are described in our Workflows documentation.

Processing of uploaded Documents

Akahu Apply is primarily designed to process financial statements downloaded directly from the financial institution.

Akahu Apply can process PDF documents containing multiple financial statements. Any pages that do not appear to be financial statements will be skipped.

If the financial statement has had additional processing, for example being printed and then digitally scanned, a best effort attempt will be made to extract the information from it. This additional extraction, called OCR, will cause these documents to take longer to process and may fail due to issues like:

- The document is slanted.

- The document is stained.

- The document has been manually annotated.

- The document has low resolution.

When accepting PDF uploads, it is always possible for a sophisticated and committed applicant to doctor a financial statement in a way that cannot be detected when extracting the data. However in the vast majority of scenarios where an applicant has tampered with a file, the tampered components are ignored by Akahu Apply when extracting data from the file, or the tampered file would fail to be processed at all. If you are concerned with the integrity of your data, sourcing documents through Open Banking Connections is a safer and more secure option.

Open Banking Connections

Financial data can be imported into an application using an Akahu one-off open banking connection. This connection is facilitated as part of the Sharing Request flow.

Open Banking Connections allow the applicant to contribute data to an Application by consenting to data sharing and connecting their financial accounts via Akahu. The relevant financial data is collected directly from the applicant's financial institution and automatically added to the Application dataset.

Completion of an Open Banking Connection will also result in one or more Documents being automatically added to the Application, because PDF bank statements are collected as part of this process.

Open Banking Connections are the best method of applicant data collection due to the complete dataset that is provided. This reduces the risk of issues introduced by the applicant failing to supply a complete set of documents.

Sharing Requests

You can invite your applicant to provide financial data for their Application by creating a Sharing Request. Each Sharing Request is associated with a specific Application, and you can create multiple Sharing Requests per Application.

Using a Sharing Request, you can send your applicant to an Akahu Apply web page where they will be guided through the process of sharing the requested financial data. Any Resources created by the applicant during this process will automatically be attached to the associated Application. Akahu Apply supports two methods for applicant data sharing:

- Manual upload of PDF bank statements.

- Open Banking Connections flow.

The applicant can use a combination these two methods as needed to provide the full scope of requested data.

Sharing Requests can be customised with the following options:

- Number of days of historic data requested (between 30 and 365).

- Disable/enable manual document upload.

Sharing Requests created via API can also be created with a redirect URI. This should be a URI in your application that the user will be navigated to upon completion of the Sharing Request. If you do not supply a redirect URI, the user will be shown a generic success page and instructed to close the browser tab.

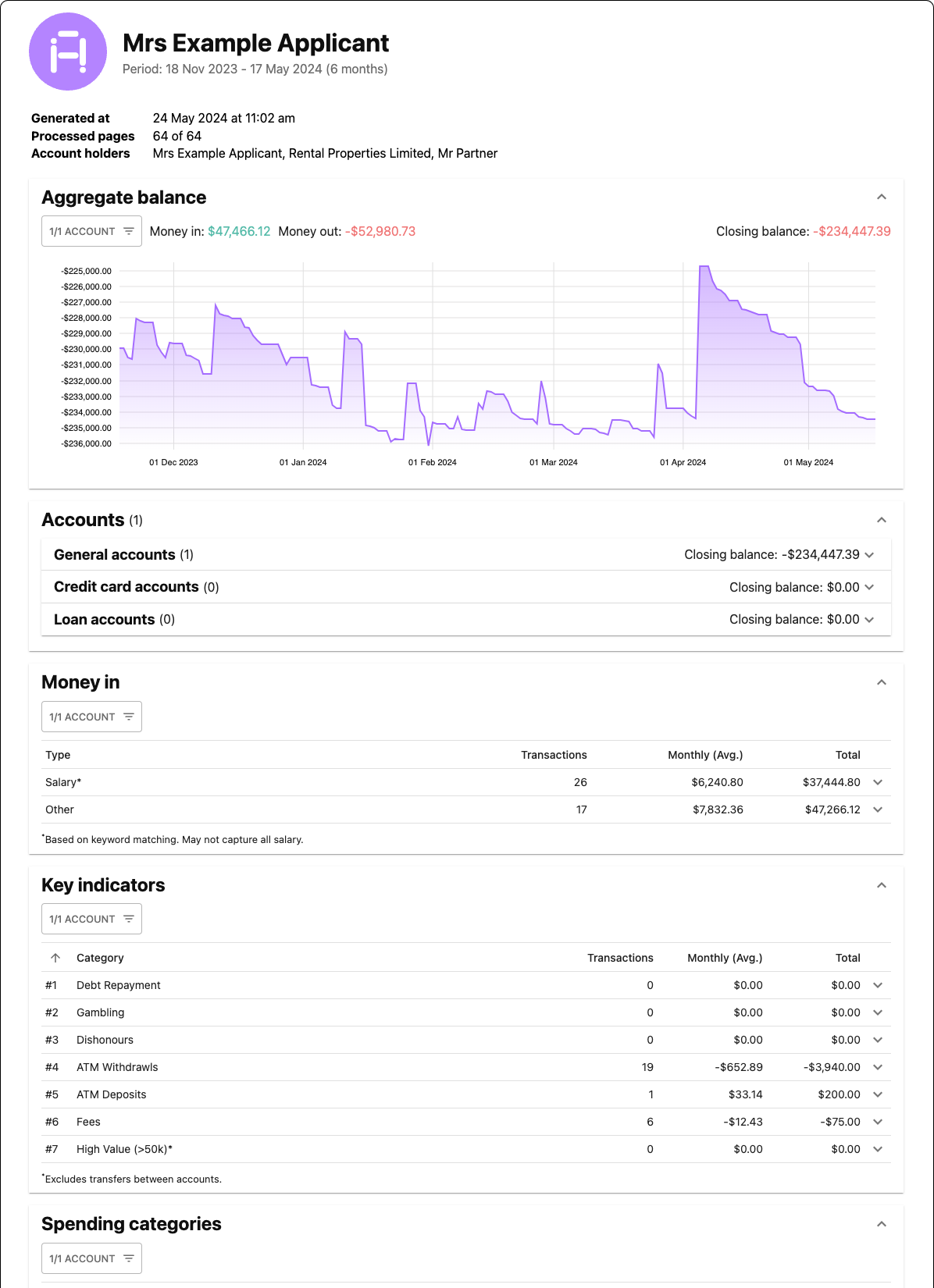

Reports

Once an Application has been populated with one or more data Resources, a Report can be created. A Report combines all of the data from the Application’s Resources into an aggregate, enriched dataset.

The compiled Report data can be accessed in JSON format via API for further analysis.

A human-friendly version of the report data can be downloaded as an interactive HTML file that can be viewed using a web browser.

Reports are generated using a snapshot of the Application dataset at the time of creation. If you add or remove Resources from an Application, it is necessary to generate a new Report to capture those changes.

Accounts

Each financial account included in the Report dataset is represented by an Account record. If data relating to the same financial account is included in multiple Resources, the data will be combined (deduplicated) into a single Account record.

Each Account includes information such as the Account type (e.g. depository, loan, or credit card), the date periods for which transaction data is available for the account, opening and closing balances, and credit limits.

Below is an example account record:

{

"_id": "report_acc_ra2se6ggwwhhro94x56tlaqy",

"type": "DEPOSITORY",

"identifier": "38-0000-0000000-00",

"holder": "Mr Example Applicant",

"periods": [

{

"_source": "src_jui8wiu2q15bom4b6yt25yxx",

"opening_balance": 380.96,

"closing_balance": 1053.02,

"limit": null,

"start": "2025-03-31T11:00:00.000Z",

"end": "2025-06-29T12:00:00.000Z"

}

],

"provider": {

"_id": "conn_cjgaac5at000001qi2yw8ftil",

"name": "Kiwibank",

"logo": "https://cdn.akahu.nz/logos/connections/conn_cjgaac5at000001qi2yw8ftil"

}

}

Transactions

The flow of money in and out of each Account is described by Transactions.

Akahu Apply provides enriched transaction data with insights such as income and expense categorisation. Key indicators on transaction data highlight activity that is relevant for lending decisions, such as ATM withdrawals and dishonoured payments.

Interesting fields on each transaction include:

action- One ofmoney_in,money_out, ortransfer. This field describes the net flow of money in the context of all Accounts in the report dataset.nzfcc- The New Zealand Financial Category Code (NZFCC) that has been assigned to the transaction by Akahu Apply. This is the most granular and flexible tier of categorisation provided by Akahu Apply. However due to the large number of NZFCCs, we recommend that you instead start with our income and spending categories, falling back to the underlying NZFCC only if necessary for your use-case.income_category- The income category that Akahu Apply has assigned to the Transaction.spending_category- The spending category that Akahu Apply has assigned to the Transaction.merchant- If the Transaction ismoney_outand Akahu Apply has identified a merchant as the counterparty of the Transaction, this contains the details of the merchant such as their name and logo.

Below is an example of a transaction record:

{

"_id": "report_trans_hlyt2oipojdbz8gteqtwmoi7",

"_account": "report_acc_daqj6g4rjtprk1qzpjjv7wbi",

"_source": "src_quawo2v7t625wlx8pch6in09",

"action": "money_out",

"type": "DEBIT",

"date": "2025-05-10T12:00:00.000Z",

"description": "MATAKANA LIQUOR CENT MATAKANA",

"amount": -74.99,

"balance": 1295.6,

"merchant": {

"_id": "merchant_cjtw6ueag0020s3ojfequ70zw",

"name": "Liquor Centre",

"logo": "https://cdn.akahu.nz/logos/merchants/merchant_cjtw6ueag0020s3ojfequ70zw"

},

"nzfcc": {

"_id": "nzfcc_ckouvvyac001c08mlbyp5doni",

"name": "Liquor stores"

},

"income_category": null,

"spending_category": {

"code": "spending:005/entertainment",

"name": "Entertainment"

}

}Updated 5 months ago